No one envisioned that two smart chips could create a digitally-signed token WITHOUT interacting ONLINE at the instance of making a payment. With the MiniPay solutions, the 5th Payment Revolution has just started; it's a logical evolution for using Smart Chips embedded on a card or any kind of device.

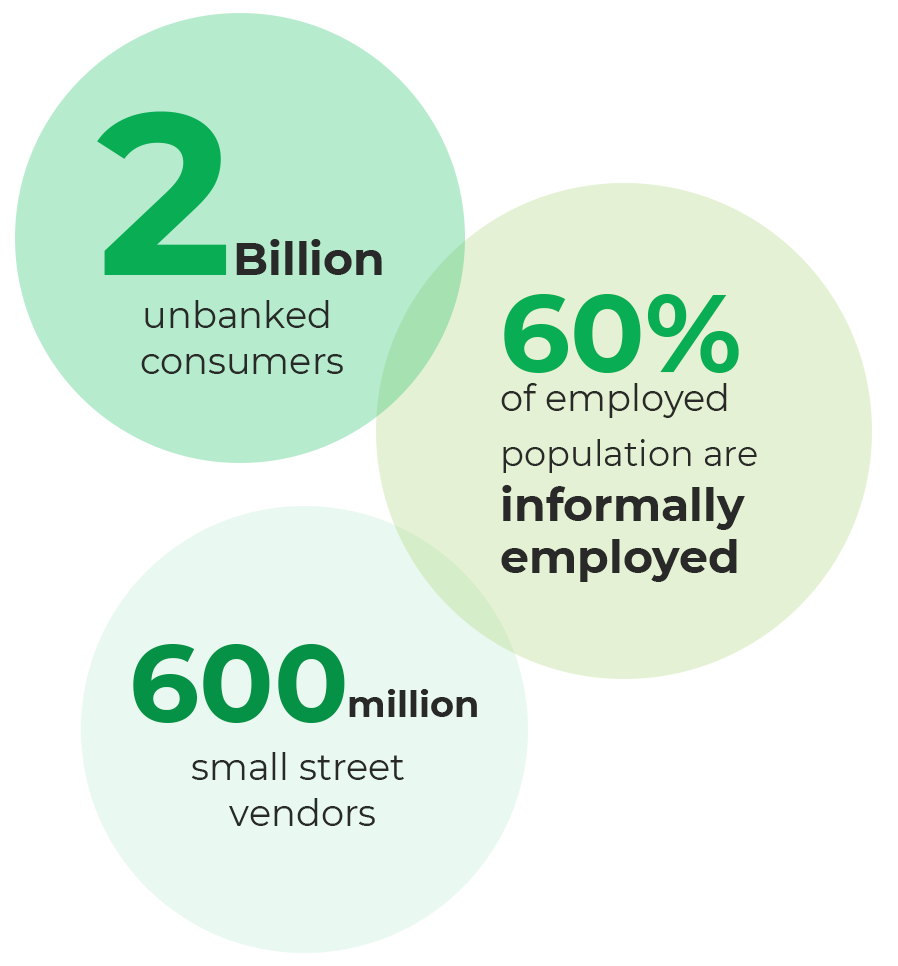

Existing payment solutions offered in today's market create EXCLUSION where the Street Vendors, small merchants cannot accept digital payments.

Moving towards a cashless society requires a solution that works for everyone, at any time, without being dependent on the internet or mobile access. Current payment solutions are outdated, it takes too a long time for making a payment and dependency of smartphones for everyone is a nice dream and vision, but what will we do when there is no communication available?

The infrastructure cost of traditional POS Terminals (card acceptance devices) is too costly for most small street vendors and service providers. MiniPay is a complement to the FinTech industry by providinga a most needed offline complement which including everyone, especially in developing countries, even the last mile vendor, with their safe, affordable and fair payment solution

As a spearheading Tech-Team for more than 37 years, our Team has witnessed great initiatives flourish, with grand visions, but never reaching their goals, because they didn’t create INCLUSION. This inspired us with an idea that others hadn't thought about but which became so obvious to us.

WHY DEPEND ON ONLINE WHEN OFFLINE WILL SOLVE THE PROBLEM!!!

ViA Global Solutions Pte Ltd (ViA) continues its mission of bringing the ViA Model and the ViA Concept to the entire world. With our latest patent applied solution, ViA MiniPay, the Swedish tech-duo of Lars Olof Känngård, the ViA Groups founder and CVO (Chief Visionary Officer) and his equally-brilliant partner, Mats Engström, are now paving the way for Financial Inclusion in India, Asia and the African continent as the initial step in crossing the threshold of global success.

The global estimation of actual street vendors can exceed 1.8 billion, states CITYLAB. In a recent street vendors survey in Mumbai, India it is clear that the vendor's biggest problem is the time it takes to return any change and the insecurity to carry cash, conducted by the ViAcard India Ltd's team.

Throughout the next pages of our website you will see many examples of Swedish Technology at its finest.

When vi say ViACARD that can be any smart chip-based card, even an access card for multi-purpose services and multi-function ID cards, not limited to a brand. The ViA MiniPay solution and the ViA Offline Wallet smart chip solution are OPEN solutions for autonomous adoption to any country.

We are still looking for investor/s and country partners. If you are interested and possess financial resources (yourself), please visit the contact page and send us a message.

Investors